For 55 years, Quebec has been a bad faith partner on Churchill Falls

Now we’re signing on for another 51 years.

Fool us once, shame on them.

Fool us twice…

For 55 years, Quebec has been a bad faith partner on Churchill Falls

Now we’re signing on for another 51 years.

Fool us once, shame on them.

Fool us twice…

Sign to Help Stop the Giveaway of Churchill Falls

Newfoundland and Labrador is being locked into another one-sided deal with Hydro-Québec — a 51-year agreement that sells our province’s most valuable clean energy resources at bargain-basement prices. While global demand for electricity is exploding, this MOU repeats the mistakes of 1969 and risks billions in lost value for our children and grandchildren.

Add your name today to demand that our province reject this deal.

Add your name today to demand that our province reject this deal.

WHY IS THIS A BAD DEAL FOR NEWFOUNDLAND & LABRADOR?

The new Churchill Falls MOU is a bad deal for Newfoundland and Labrador. It locks us in for 50 years on terms that:

- Sell our power too cheap – Churchill Falls electricity would be priced far below what it’s really worth.

- Cap our future gains – if clean power prices rise, we won’t benefit.

- Give Hydro-Québec too much control – they decide the timing, design, and construction of new projects.

- Shut the door on other offers – we’re tied to Hydro-Québec for years, without testing the market.

1. No Transparency, No Trust

Independent Oversight Committee Whistleblower Michael Wilson says NL Hydro’s board failed its basic duty to provide accurate, complete information. Fact sheets and public statements have left out key details, leaving the public confused and unable to judge the deal fairly .

2. The Structure is Flawed

The MOU bundles two completely different negotiations into one package:

- A new price for existing Churchill Falls power.

- Cost-plus deals for new projects (Gull Island, CF expansion, transmission).

By tying them together, Newfoundland and Labrador can’t get a fair price for Churchill Falls without also giving Hydro-Québec new ownership, control, and exclusivity.

3. Selling Power Too Cheap

- Hydro-Québec’s replacement cost for power is about 13¢/kWh. The MOU locks us into an average of 5.9¢ (present value), only slightly above the inflation-adjusted 1969 price of 2.6¢.

- Wilson shows this means a 55% surplus for Hydro-Québec, amounting to nearly $200 billion in savings for them — money that should be ours.

- Former EY partner and former Chair of MUN Board of Regents Gil Dalton adds: this isn’t just underpricing, it’s effectively an advance or loan disguised as revenue, with future power discounted to make the math work.

4. No Upside on New Projects

- All new projects use cost-plus pricing: Quebec pays costs plus 8–9% return. That means if power prices soar with electrification and AI data centers, we don’t benefit – Quebec does.

- Quebec’s CEO has admitted this is the “lowest price possible”, saving them billions.

Dalton says this must be fixed with a reset clause every 5 years so pricing reflects fair market value. Without it, NL is stuck for 50 years at cost-based rates.

5. Control for Quebec, Risk for Us

- Quebec leads the design and construction of Gull Island and the CF expansion.

- Cost overruns are not paid by Quebec, but added as debt to CF(L)Co, where NL owns the majority.

- Quebec gets 15 years of exclusivity on Churchill River projects, blocking NL from considering other partners.

6. Technical & Safety Risks

Dr. John Gale, a former Hydro director and engineer, warns:

- The expansion adds turbines without adding water, meaning Churchill Falls is converted into a “peaking operation” – power sold by HQ at premium prices, but not priced that way for NL.

- Blasting a second powerhouse only 250m from the first could threaten the stability of the existing plant.

7. Foundations Missing: Equity & Water Rights

Dalton stresses that two fundamentals are ignored:

- NL should always hold at least 75% equity in Churchill River projects, with clear exit provisions for Quebec.

- Water rights should revert to the province at the end of contracts, ensuring future flexibility.

8. The Bigger Picture: Who Really Benefits?

- Wilson shows 90% of supposed benefits only arrive after 2041, long after Hydro-Québec secures decades of cheap power.

- Dalton points out Quebec will use this bargain power to attract billions in new investment – AI data centers, industry, jobs – while NL loses out.

CRITICISM OF CHURCHILL MOU IN THE MEDIA

MOU Whistleblower on 1969 Pricing *GOING DOWN* under new MOU – VOCM Open Line

Oct. 7, 2025

Michael Wilson breaks down the formulae for the pricing of power generated.

MOU Whistleblower on 35 Year Timeline for “Labrador Recall Power” – VOCM Open Line

Oct. 7, 2025

Micheal Wilson discusses the terms how much power Labrador will get and how long it will take.

MOU Whistleblower resigns – NTV Evening Newshour

Sept. 2, 2025

A member of the Churchill Falls “Independent Oversight Panel” resigns, questioning panel’s independence and usefulness.

Lawyer Bernard Coffey Addresses MOU shortcomings – NTV Issues & Answers

Aug. 31, 2025

Bern Coffey – lawyer and former Clerk of Executive Council – recently co-signed a Letter from 9 prominent NLers calling on NL Hydro to reject the current MOU.

Letter to the NL Hydro Board; NTV News

Aug. 27, 2025

Former politicians, civil servants write letter calling on N.L. Hydro Board to resign over Churchill Falls MOU.

Rollie Martin, former NL Hydro Director

CBC Radio

“Reject or resign” says one group of former politicians to the current board of NL Hydro. Why the supergroup fears the Churchill Falls MOU could be the ‘biggest strategic error’ in the province’s history.

N.L. Hydro CEO defends Churchill Falls MOU while ‘Group of 9’ critics raise more concerns

September 4th, 2025

Signs of an election call in the near future are getting clearer, with parties making campaign promises, and the debate heating up over Churchill Falls.

Quebec's Emerging Electricity Shortage and It's urgent Need for Additional Power

September 30th, 2025

Evidence that the known drought in the James Bay River Basin is curtailing Hydro-Quebec’s ability to generate hydroelectricity. To meet the shortfall, HydroQuebec is curtailing exports and increasing imports from the USA.

“The new deal will likely become the biggest strategic error in the history of our province … the province is giving away NLH’s energy crown jewels for trinkets.”

ARTICLES ON CHURCHILL MOU

Churchill Falls Whistleblower wants Gov to release his resignation letter — in full

September 11, 2025 – CBC News

Group of 9 Claims NL ‘Repeating the 1969 Giveaway’ that was the Lower Churchill Contract

September 4, 2025 – VOCM Local News

The Telegram - The same deal as in 1969 at the end of the day': NL must question Gull Island MOU

September 30, 2025 – VOCM Question of the Day

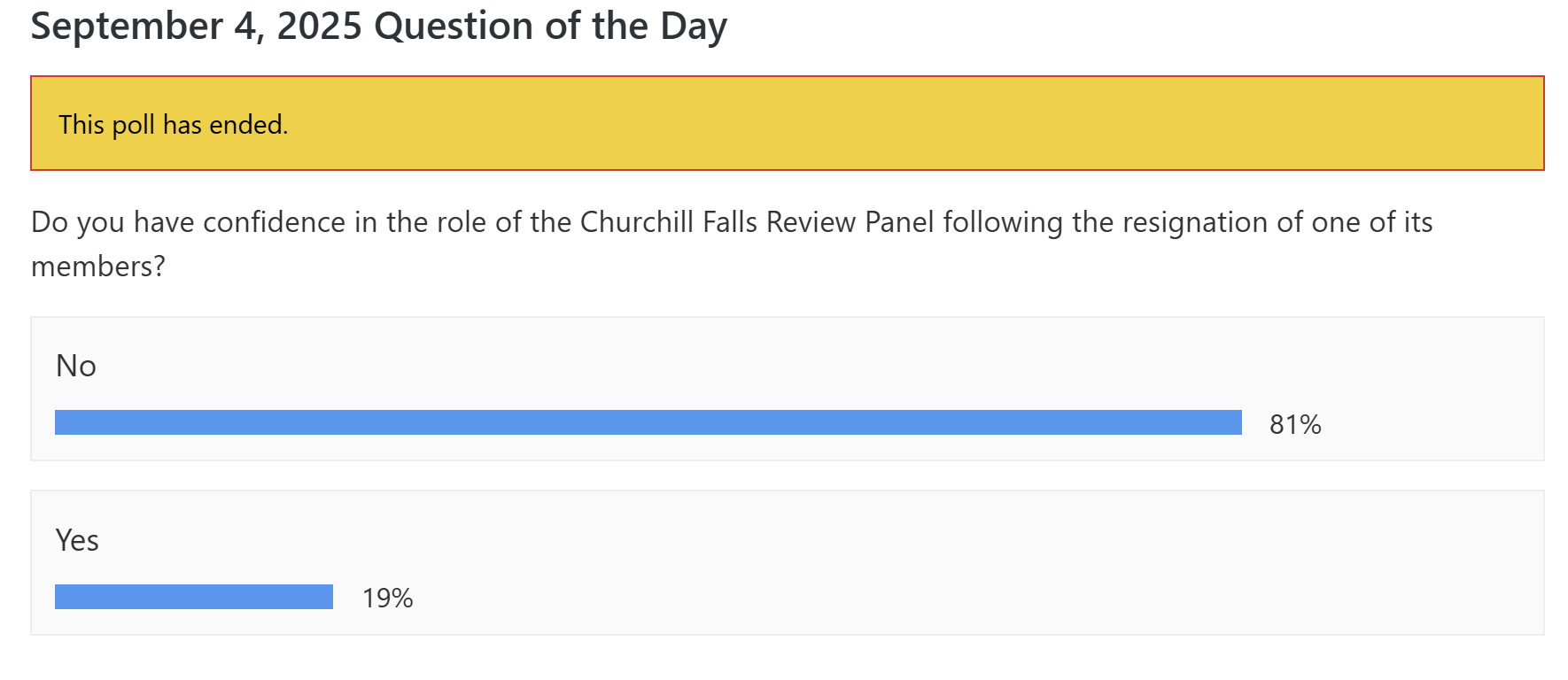

VOCM Poll – Public has lost faith in Oversight Committee

September 4, 2025 – VOCM Question of the Day

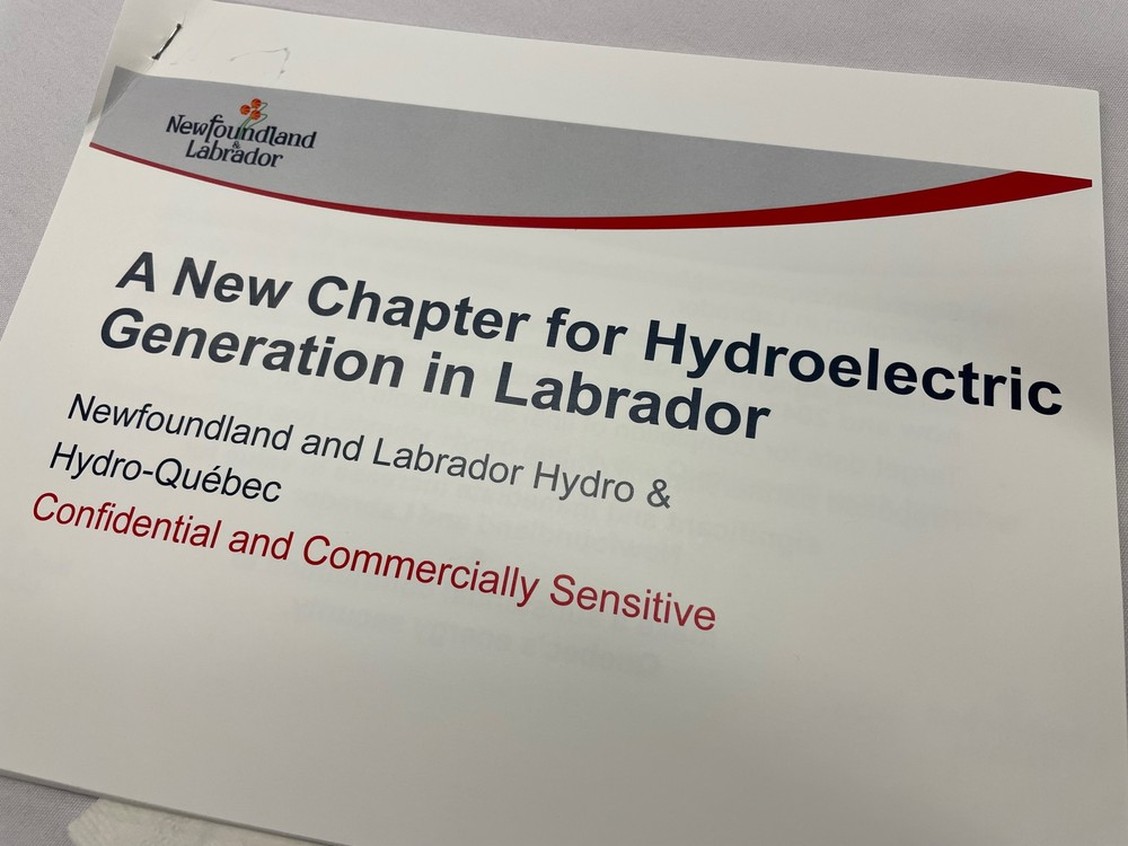

Resources ON CHURCHILL MOU

A Detailed Assessment from MOU Whistleblower Michael J. Wilson, September 21, 2025

Download the PDF

Former EY Partner & Chair of MUN Board of Regents, Gil Dalton – Comments on the NLH / QH MOU

Download the PDF

An Open Letter to the Board of NL Hydro from "Group of 9"

Download the PDF

Contact Us

The Office of the Premier

Confederation Building, East Block

P.O. Box 8700

St. John’s, NL A1B 4J6

August 28, 2025

Dear Premier Hogan:

First of all, I wish to congratulate you on your election as the Leader of the Liberal Party and on becoming our province’s 15th Premier. Public service is an honourable and all-consuming endeavour, and I am appreciative of all who put themselves forward to serve our province.

As you are aware, I have expressed some very serious and consequential concerns about the existing Upper Churchill/Gull Island MOU between Hydro Quebec and the Government of Newfoundland and Labrador. I wish to assure you that these concerns are unequivocally in no way partisan or politically motivated; rather they are based on a very thorough analysis of the MOU. I feel genuinely alarmed and worried for the future of our province and the generations who will be seriously impacted by the eventual fall out. I hope you would agree that this matter deserves meaningful consideration, particularly in light of the vast number of like-minded businesspeople, former Hydro officials, bureaucrats and people of all political stripes and backgrounds, who have emerged to offer sincere critiques of the MOU.

I recently wrote to Prime Minister Carney simply to express my perspective after hearing some comments at the Council of the Federation meeting, that this MOU is a nation building project. The benefits that will accrue to Quebec are extraordinarily lopsided compared to the benefits that will accrue to Newfoundland and Labrador, and this is evident when the MOU is fully analyses. The Prime Minister responded and recommended that I contact you directly to discuss these issues. As the one individual who holds the future of our province and our people in your hands, I would request an opportunity to meet with you one on one, so that I can fully explain the various areas of concern within the MOU; and to also hear directly your position on these matters. I thank you in advance for your consideration.

Sincerely,

Danny Williams

The Editor, The Telegram

August, 25th, 2025

Dear Editor,

We, the undersigned, believe that the recently announced Memorandum of Understanding between NL Hydro (NLH) and Hydro-Quebec (HQ) represents the most consequential economic decision our province has faced in a generation. And, given our less-than-stellar history on such matters, that any government allowing it to proceed without rigorous and continuous guidance from a definitively arms-length panel of independent experts is being demonstrably negligent.

Though we don’t count ourselves as “experts,” the 1969 contract and other notable debacles have made it painfully clear that applying the “just trust us” approach to such monumental decisions should no longer be considered responsible or acceptable. As for the few actual NL experts who have taken it upon themselves to evaluate the available information, we would do well to pay better heed to them than when they warned us about Muskrat.

This time, they caution that:

- The upfront cash we gain from locking in early is a trade-off for a lower price per kilowatt-hour (kWh) after 2041-essentially mortgaging our future for a short-term fix. In blunter terms, selling out our children and grandchildren.

- The price per kWh will be heavily indexed to Québec’s lowest-in-G7 electricity rates rather than the

broader markets in Ontario, New England, or beyond. - Gull Island power will be sold at a fixed cost-based rate, which will restrict our return to a defined premium over the cost of borrowing, despite rising demand and unknowable real market rates.

- And, the promised $1 billion per year in revenue for the next 17 yearsis misleading. For, after subtracting operating costs and Hydro-Québec’s 34.2% profit share, NL’s actual revenue will be closer to $650 million in nominal dollars.

There have been other red flags raised, relating, but not limited to, significant new financial exposure, loss of control of the pace of development, the lack of a water management agreement, and insufficient information being released to allow a proper cost/benefit analysis of this approach as compared to alternatives. But given limited space and short attention spans, we come to the crux of the matter: If any of these claims are true, they should be considered deal-breakers.

Justice LeBlanc, in his report on Muskrat Falls, recommended that all future projects exceeding $50 million be vetted by a panel of independent arms-length experts to ensure transparency and to reduce the risk of mistakes rooted in bureaucratic groupthink and short-term political opportunism. The government will point to the Independent Churchill Falls Oversight Panel as evidence of compliance with this elemental safeguard. But, given that the panel was appointed by, is paid by, and reports directly to the very government it’s meant to oversee, it bears greater resemblance to an arm of that same government than an independent watchdog. We cast no shade on the credentials or character of the panel members, but a body that lacks the institutional guardrails of independent funding, peer-reviewed reporting, and non-governmental appointments fails to meet the widely understood meaning of “arms-length.” In matters of such consequence, even the perception of a reluctance to speak truth to power can be self-defeating. The recent firing of the Commissioner of the US Bureau of Statistics, after she delivered a disappointing jobs report, underscores the importance of properly structured arms-length arrangements in safeguarding the neutrality and integrity of public institutions in the face of political pressure.

So… we ask:

- Why ignore the hard-earned lessons of Muskrat? Why not follow Justice LeBlanc’s advice and engage global experts (alongside local ones) within an unambiguously arms-length arrangement?

- Why even agree to sit at the table without first securing a commitment that future prices will be unbreakably indexed to free-market rates?

- Will the full pricing formula be made public before signing?

- Considering Hydro-Québec’s timelines to secure a stable supply before 2041, are we committing too early? In light of impending interprovincial trade reforms (there are even whispers of a national electrical grid), are we already in a stronger bargaining position than when the MOU was negotiated? And, isn’t our hydro power becoming even more valuable as a backstop to large-scale, but intermittent, wind and solar?

- Is it wise to bundle multiple large projects and expenditure commitments into one agreement? Shouldn’t follow-up phases be contingent on NLH and HQ meeting clearly-defined benchmarks?

- Is the rush to a hydro deal partly rooted in broader considerations, like mining developments and expansions in Labrador? If so, let’s remind ourselves that this is a fifty-one-year contract, and the minerals will still be there in a year or two.

- Given that Churchill Falls provides some of the cheapest, most stable electricity in North America and that former HQ CEO Michael Sabia has called Gull Island “the best-remaining hydro project in North America,” are we undervaluing these assets for the political sugar rush of short-term jobs?

So far, the government has been less than forthcoming in addressing these and other reasonable questions. Yes, the issues are complex-but a lack of transparency breeds mistrust and increases the risk of irreversible mistakes.

This letter is not about partisanship, but about encouraging robust debate and oversight on a decision that will shape our province’s future. And, given that our ability to fund healthcare, education, and infrastructure in the coming decades will largely depend on getting this right, shouldn’t proceeding with the utmost caution be a shared priority?

To our political leaders: Let’s rise above partisanship, and let every candidate in the upcoming election declare their position on how we proceed. Let them tell us if they stand for more of the “just trust us” approach, or for transparent, arms-length oversight as recommended by Justice Leblanc.

To our fellow citizens: How do you feel about continuing to sell electricity at a significant discount to HydroQuébec, while here at home we struggle to keep our hospitals staffed, our roads repaired, and our schools properly funded? If that doesn’t sit right with you, then let’s make this election a referendum on how we can best avoid the mistakes of the past and get this future-defining deal done right.

Yours sincerely,

Alvin Hewlett, Alton Hollett, George Power, Ray Hawco

December 12, 2024, MOU – It’s All About the Price!

August 2025

INTRODUCTION

Michael J. Wilson, CA, FCA – prior to my retirement in 2013, I was an executive partner with a global professional services firm. I have significant experience in negotiating and/or reviewing complex multi-entity, multi-jurisdictional contracts and agreements. I also have significant experience in designing and deploying effective oversight mechanisms focused on critical corporate functions and initiatives.

I was appointed to the Independent Churchill River Oversight Panel (the Panel) because of my independence, orientation, skills and experience. I resigned on May 12, 2025 because, in my view, the independence of the Panel became impaired and I no longer believed the Panel’s reports would meet the public’s expectations and need for an independent analysis supported by a full and frank commentary.

My objectives in providing this commentary and analysis are: to provide a healthy challenge to published information; facilitate a more informed discussion; and encourage a more balanced outcome. This commentary and analysis is limited by the content of public information and the facts and assumptions stated herein, it should be read with the appropriate caveat. It was prepared after the release of the Panel’s second quarterly report. I was not involved with the preparation of the second report released in July 2025.

The July report does not provide any findings arising from a detailed review of the MOU; it does not provide any insight as to the reasonableness of projected costs, risks or if the projected benefits are fairly stated; it does not identify open items to be negotiated or key decisions to be made during ongoing negotiation process; and it provides little insight as to the specific oversight mechanisms deployed by the Panel to ensure public policy and commercial objectives will be achieved.

The MOU is long and it’s complicated therefore it is unlikely many would take the time to unravel its complex verbiage, identify information gaps and develop a perspective as to if the economic benefits are balanced or would materialize as projected. Consequently, the public at large is dependent upon those who have the time, interest and skills to review the MOU in detail and assess the fairness of the value sharing between the parties. My analysis, while limited in scope, indicates there may be significant opportunities to improve the anticipated outcomes for the province, in particular with respect to pricing.

Issues for discussion include but are not limited to:

- What is the justification for selling 40% of the “value” of Gull Island (GI), the most valuable undeveloped resource in the province, without an independent valuation? The transaction “price” and other commercial terms require an enormous amount of scrutiny.

- What is the justifica9on for selling existing Churchill Falls (CF) power to Hydro Quebec (HQ) at a “price” at least 50% lower than the current replacement “cost”? How does this represent fair “value”?

- What is the justification for selling 100% of the power from all new developments to HQ for a “price” equal to the “cost” to generate, without a “price” escalation clause tied to the increase in the “value” of the power? The proposed pricing mechanism provides a lower rate of return than the 1969 contract.

The opportunity to renegotiate the 1969 CF contract and monetize the potential of the proposed new developments could be transformational if the full value is captured by the province.

CONFUSION AND FEAR

- The MOU debate has resulted in much confusion and expressions of fear. The MOU is very confusing, to a large extent because it intertwines two distinctly different types of negotiations into one agreement.

- The first, a renegotiation of the existing CF power purchase agreement (PPA) is inherently a distributive negotiation in that CF(L)co generates the power needed by both HQ and Newfoundland and Labrador Hydro (NLH) and the primary issues to be agreed are “price” and volume allocations. All Parties have access to CF(L)co information, so it is difficult to accept the existence of commercially sensi9ve information in this situation.

- The second, is inherently an integra9ve negotiation in that NLH and HQ agreed to: cooperate and collaborate transparently to create the maximum value from the new developments and agree how that value is to be shared in a fair and equitable manner going forward (ie. 60/40) and then agree to “price” and volume alloca9ons. Given the

expressed and agreed need for transparency, it is difficult to accept the existence of commercially sensitive informa9on at this stage of negotiations.

The industry, commercial and accounting terms used throughout the MOU are unfamiliar to many and may cause confusion. Many press releases, including direct quotes from politicians and both senior hydro officials, have also added to the confusion and highlight the frequent misuse and possible misunderstanding of terms such as cost, price and value. To clarify, “cost” is an accounting term, a calculated number that may be audited to ensure its accuracy and completeness. “Price” is the transactional amount agreed between a buyer and a seller paid to acquire a commodity. “Value” is an estimate of the monetary worth of the commodity to be acquired. “Value” may differ significantly from both “cost” and “price”.

Added to this confusion is the great fear expressed by many that:

- the lessons learned from previous mega projects may not be heeded;

- the posture and negotiating tactics of HQ may dominate the structure and flow of ongoing negotiations and balance the outcomes in favor of HQ;

- HQ will have 100% control over the design, construction, financing and timing of any new development on the Churchill River (CR) until 2041;

- entities with existing business rela9onships with HQ may have a significant competitive advantage in obtaining contracts;

- the NLH preliminary cost projections are dated therefore likely unreliable;

- HQ has not publicly agreed to NLH preliminary cost projections and significant differences may occur upon the completion of new and or updated studies;

- the NLH benefit projections are based upon a significant number of hypothetical

assumptions long into the future and consequently may not materialize as projected; - the potential for management and political bias is ever present in public representations (Fact Sheet, press releases etc.);

- effective oversight mechanisms have not been and may never be effectively deployed;

and - scheduled reports and updates may not meet the needs and expectations of the public.

KEY FINDINGS – it’s all about Price, Price and Price

RenegoIaIon of the 1969 CF PPA

A detailed review of the terms of the MOU and other publicly available information related to the 1969 CF PPA renegotiation result in the following key findings:

- The CEO of NLH stated “the worth of CF to HQ is between 11-13 cents” however the power will be sold to HQ for an agreed average price of 5.9 cents (pv).

- According to the MOU the “price” paid for CF power is intended to reflect the projected fair “value” of the power, however it is unclear how and when this objective will be accomplished.

- HQ will not pay 11 cents un9l 2050 – 25 years hence.

- The initial 1969 price of approximately .03 cents equates to approximately 2.6 cents today. HQ will con9nue to pay less than 2.7 cents un9l 2030 – 61 years later.

- The new CF PPA appears to be a firm price contract as the stream of payments set out on Schedule G have been predetermined to target $33.8 billion (pv).

- The MOU is unclear as to the relationship between the amounts paid by HQ to CF(L)co prior to 31/12/41 ($19.8B – 10%) and the amounts to be paid thereafer ($174.8B – 90%).

- It would appear that the payments prior to 2042 may simply be an advance (perhaps to help address the GNL short-term fiscal needs) of payments otherwise payable thereafer.

- In any event, it is quesIonable if the financial benefits accruing to the GNL arising from HQ payments payable aNer 2041 (amounIng to 90% of the projected benefits) can reasonably be attributed to the early termination of the 1969 CF PPA.

The shared economic benefits from the renego9a9on of the CF 1969 PPA may be summarizedas follows:

- Depending upon the true nature of the relationship between the pre and post 2042 payments, CF(L)co may receive between zero and $19.8 billion in “additional” revenue from HQ throughout the term of the new CF PPA.

- The price of 5.9 cents (pv) is considered to be approximately half the cost of clean renewable energy alternatives available in North American thus saving HQ

approximately $194.6 billion throughout the term of the new CF PPA.

The CR New Developments

A detailed review of the terms of the MOU and other publicly available information related to the proposed new developments on the CR result in the following key findings:

1. CF Upgrade and Expansion

• Similar to the 1969 contract, there is no mechanism in the MOU to provide for an escalation in “price” should the fair “value” of power from the CF upgrade and CF expansion increase in future years.

• Construction cost overruns for the CF upgrade and CF expansion will not be “funded by HQ”, rather they will be capitalized in the financial accounts of CF(L)co and funded by new CF(L)co debt.

• At the end of the contract approximately 23% of the original capital cost including cost overruns for the CF expansion will remain on the books of CF(L)co to be recovered from future off-takers.

• The projected return on investment (ROI) for NLH from the CF upgrade and CF expansion is approximately $90 million per year or approximately $4.5 billion over 50 years.

2. Gull Island Joint Venture (GIJV)

• The MOU provides that HQ will acquire certain rights and a 40% interest in the future value of GIJV, the most valuable undeveloped resource in the province. It would be helpful if a fairness opinion or discounted cash flow calculaIon was provided to support the transacIon price, but such is not the case.

• Similar to the 1969 contract, there is no mechanism in the MOU to provide for an escalaIon in “price” for the GI power should the fair “value” of power increase in future years.

• The MOU sets out the agreed volume allocations and provides that the “price” shall equate to the “cost” (as set out in the new GI PPA’s) estimated by HQ to be 11 cents on average.

• It should be noted that the HQ 11 cents estimate appears to be a nominal dollar estimate not a present value (pv) estimate.

• NLH have not provided a nominal dollar or present value estimate.

• Using a discount rate of 5.822%, for 51 years, an 11-cent average equates to a present value average of approximately 3.5 cents – 2.4 cents less than the very low average price to be paid for the CF power.

• The present value of 11 cents in 2085, discounted at 5.822% is .037 cents.

• The MOU provides that HQ will have 100% control over the design, construction, financing and 9ming of the Gull Island (GI) development until 2041.

• The MOU provides the power block (2250 MW’s) generated by the GI development will be allocated 100% to HQ throughout the term of the contract.

• Cost overruns for GI project will not be “funded by HQ” rather they will be capitalized in the accounts of GIJV and funded by new GIJV debt.

• At the end of the contract approximately 23% of the original capital cost including cost overruns will remain in the accounts of GIJV to be recovered from future off-takers.

• For the GIJV investment NLH will receive a ROI of approximately $317 million per year or approximately $16 billion over 50 years.

The shared economic benefits from the new developments may be summarized as follows:

The CEO of HQ has stated “the price paid for the power from the new developments is the lowest price possible for HQ and will provide over $200 billion of cost savings compared to existing alternatives”. Approximately $4 billion per year.

The total projected ROI for NLH related to the new developments will amount to an estimated $20.5 billion or on average $410 million per year, with zero possibility of a “price” increase resulting from an increase in the fair “value” of the power.

Should one apply the commercial terms set out in the MOU for the proposed new GIJV to the 1969 CF(L)co project the following would result:

• Cost of approximately $1 billion

• 75/25 debt to equity ratio; and 65% ownership

• equity investment required = $1B x 25% x 65% = $163 million

• Annual return of 8.5% per year = $13.8 million for 56 years = $773 million total ROI.

The total return related to the ill-fated 1969 contract for GNL is estimated to be $2 billion while QC is estimated to have received an estimated $28 billion. The MOU proposes a lower rate of return for the GIJV than the province received from the 1969 contract.

CONCLUSION

As confusing as the MOU may be, in part resul9ng from there being two significantly different agreements rolled into one and the lack of information and/or explanation of many key issues, the actual outcomes of the MOU will have significant impact on the wellbeing of every Newfoundlander and Labradorian for many years to come.

The GNL has an overwhelming responsibility to ensure the definitive agreements maximize the benefits and capture the full value of the CR for future generations.

LETTER: Former NL premier Brian Peckford

It has come my attention that interested citizens of the province have recently written you expressing their opposition to the MOU that your corporation has signed with Hydro Quebec. I have read these letters and support their views on the MOU.

As you know I am no stranger to this issue.

As minister and premier I attempted to change the original Upper Churchill Contract: both through negotiation (originally with Guy Joron, Quebec minister of energy and later with Premier Rene Lévesque), through talks with the federal government (Prime Minster Brian Mulroney) and the courts, through the Lease Agreement (initiated earlier by Premier Frank Moores) and later with new legislation called the Water Reversion Act. I introduced in the House of Assembly The Lower Churchill Development Corporation Act in 1978.

My books, “Some Day The Sun Will Shine and Have Not Will Be No More” and “The Past In The Present” details my involvement.

As minister of mines and energy, I actually prevented a deal similar to the deal you have signed, which had been secretly negotiated by Moores and some other ministers.

Let not your legacy make possible a tragic trifecta on the Churchill River — Upper Churchill Contract, Muskrat Falls Project and now this MOU.

I first opposed the MOU on Dec. 12, 2024, in a public commentary.

New Churchill Falls MOU, compared to fantasy (original contract prices, term etc.), is an improvement but compared to reality (today’s prices and terms), another bad deal.

My information is that residents of Newfoundland and Labrador are paying over 13 cents per kWh today for electricity.

My information is that Quebec’s new initial price that it has to pay under the “new” deal is 5.9 cents per kWh for Newfoundland and Labrador electricity.

Does anyone know when Quebec will be paying more for Newfoundland and Labrador power than what Newfoundlanders and Labradorians will be paying for their own power?

But I guess if your reference point is the original giveaway Upper Deal or the disastrous Muskrat Falls Project — living in the past and those ridiculous deals — almost anything now can look good. Hence, no doubt there will be many that will support the deal.

Newfoundland and Labrador is to oversee Upper Churchill Project expansion, but Quebec Hydro to oversee the financing and construction of the new Gull Island Project, and has 40 per cent ownership of the new Gull Island Company that will manage the ongoing project. I find this Quebec involvement to be excessive.

$200 billion revenue looks attractive — but over 50 years? I thought such long terms were never to be entertained again.

If one subtracts what Newfoundland and Labrador lost each year in economic rent for over four decades in any reasonable going rate deal, one would need to consider that $200 billion to be more like $150 billion. A study done in 1978 showed that in that year if Newfoundland had received the then-going rate of 23 mills per kWh for electricity, that would have meant $877 million for just that year. Later studies showed $1 billion to $1.5 billion annually.

Furthermore, how much of the remainder will go to mitigate the present high rates (Muskrat disaster a big part of that, no doubt) after which there will be little left — and given the way successive provincial governments have managed over $30 billion of new offshore royalties in the last 27 years, it is difficult to get excited.

Obviously, there is more detail, but at first blush: the new rate Hydro Quebec will pay, the term of the agreement and Quebec’s direct ongoing involvement make this a modern-day mistake for Newfoundland and Labrador.

The Upper Churchill deal was so bad, a $1.80 per barrel of oil equivalent, Muskrat Falls such a disaster, Nova Scotians getting the power cheaper than Newfoundlanders and Labradorians, that a modern-day mistake is viewed as a good deal.

Quebeckers once again can celebrate.

Source: This is an initial reaction based on initial press reports and the provincial government’s press release. It is acknowledged that a more careful study of the details of the agreement is necessary.

I urge the leadership of Newfoundland and Labrador Hydro to scrap this deal.

Hon A. Brian Peckford PC, former premier of Newfoundland and Labrador (1979–1989)

Man who quit Churchill Falls panel wants them to release his resignation letter — in full

CBC News – September 11, 2025

Mike Wilson resigned from the Churchill Falls negotiating committee in May. (CBC)

An accountant who quit a panel overseeing energy negotiations between the electric utilities of Newfoundland and Labrador and Quebec says the public should be able to read his full resignation letter.

Mike Wilson said Wednesday he is unable to share the letter himself because he signed a non-disclosure agreement. However, he called on the panel’s chair to encourage the Newfoundland and Labrador government to release the unredacted text of his resignation letter, which he submitted May 12.

The former EY executive has previously said he resigned because the panel was not serving the public as intended.

“Releasing my letter would demonstrate transparency and enable the public to make an informed decision,” Wilson said in a statement.

Hydro-Québec and Newfoundland and Labrador Hydro are negotiating final agreements of a draft energy deal unveiled in December. The Liberals established the panel in January, as a condition for the NDP and Independent members of the legislature to accept the memorandum of understanding and proceed with talks toward final agreements.

The Opposition Progressive Conservatives have criticized the panel, saying its chair, Dennis Browne, is a longtime Liberal supporter.

Leader Tony Wakeham has promised to have an independent third party review the draft energy agreement if the Tories win the provincial election expected next month.

The tentative agreement would see Hydro-Québec pay a forecasted $33.8 billion for power over the next 50 years from the Churchill Falls plant in Labrador and lead new projects along the Churchill River.

Wilson said earlier this month he believes Newfoundland and Labrador could get a better deal. He questioned the panel’s independence and said its quarterly reports would not meet the public’s expectations.

On Wednesday, Wilson said neither he nor Browne, who is also the province’s consumer advocate, could release his resignation letter because of a non-disclosure agreement.

“However, if it is truly [Browne’s] opinion there was no impairment of the independence of the panel, he could encourage the government to release my letter to the public,” Wilson said.

When asked for comment, Browne pointed to a previous statement, which said the panel’s public reports do not disclose its recommendations and findings “due to the commercial confidentiality of ongoing negotiations.”

Group of 9 Claims NL ‘Repeating the 1969 Giveaway’ that was the Lower Churchill Contract

VOCM Local News – September 4, 2025

The Churchill River and Churchill Falls (Government of Newfoundland and Labrador)

The so-called Group of 9, which includes former politicians and lawyers, believes that Newfoundland and Labrador is repeating the 1969 giveaway that was the Lower Churchill contract.

The group, which is calling for the resignation of the NL Hydro board, is challenging its handling of the December 2024 MOU with Hydro-Quebec.

Last week NL Hydro CEO Jennifer Williams re-iterated that the price set out in the MOU is not the final price.

The Group of 9 claims that NL Hydro refused to seek independent advice on the long-term deal, something its members – including Danny Williams, Ches Crosbie and Jack Harris – believe represents “a profound failure of governance.”

Former member of the Oversight Panel, Michael Wilson, resigned from the panel in May citing “impaired independence,” and warning that its reports would not meet public expectations.

The group says locking the province into a 50-year agreement now, would “repeat the catastrophic imbalance of the 1969 contract.”

Members of the Group of 9 include:

Bernard Coffey, KC – Lawyer; Former Clerk of the NL Executive Council

Ches Crosbie, KC – Former Leader, NL Progressive Conservative Party; Former MHA

Jack Harris, KC – Former Leader, NL New Democratic Party; Former MP and MHA

Roland Martin – Former Deputy Minister of Finance; Longest-serving Director, NL Hydro

Bob Noseworthy, P Eng – Former President, Pennecon; Executive Director Canadian Construction Association; President, Provincial SPCA

Roger Simmons – Former Federal Cabinet Minister; Former Liberal MP and MHA

Walter Tucker, P Eng – Former Senior Vice-President (Atlantic Canada), SNCLavalin Lorne Wheeler – Former Deputy Minister; Policy Advisor

Danny Williams, KC – Former Premier of Newfoundland and Labrador

Among the points listed by the group and highlighted for NL Hydro’s Board of Directors are:

- Secretive Process: Government-appointed panels that formed the basis of the MOU worked largely in secret, bound by NDAs, with little information made public.

- Quebec Can’t “Walk Away”: Quebec’s own media and officials admit that time weakens Quebec’s position – “time is not Quebec’s friend” (former HQ CEO Michael Sabia). Critics say NL has unprecedented leverage, not weakness.

- Show Your Work: Hydro dismissed the August 26 letter as inaccurate. The group asks Hydro to identify specific errors.

- Governance Gap: Hydro’s Board did not seek independent legal, financial, or utility advice for a multibillion-dollar, 50+ year deal. Critics say this breaches basic governance practice.

Independent Panel’s “Impaired Independence”: Michael Wilson resigned from the Independent - Oversight Panel, citing compromised independence — reinforcing the group’s call for scrutiny.

Question of the Day

VOCM Question of the Day – September 4, 2025

Do you have confidence in the role of the Churchill Falls Review Panel following the resignation of one of its members?

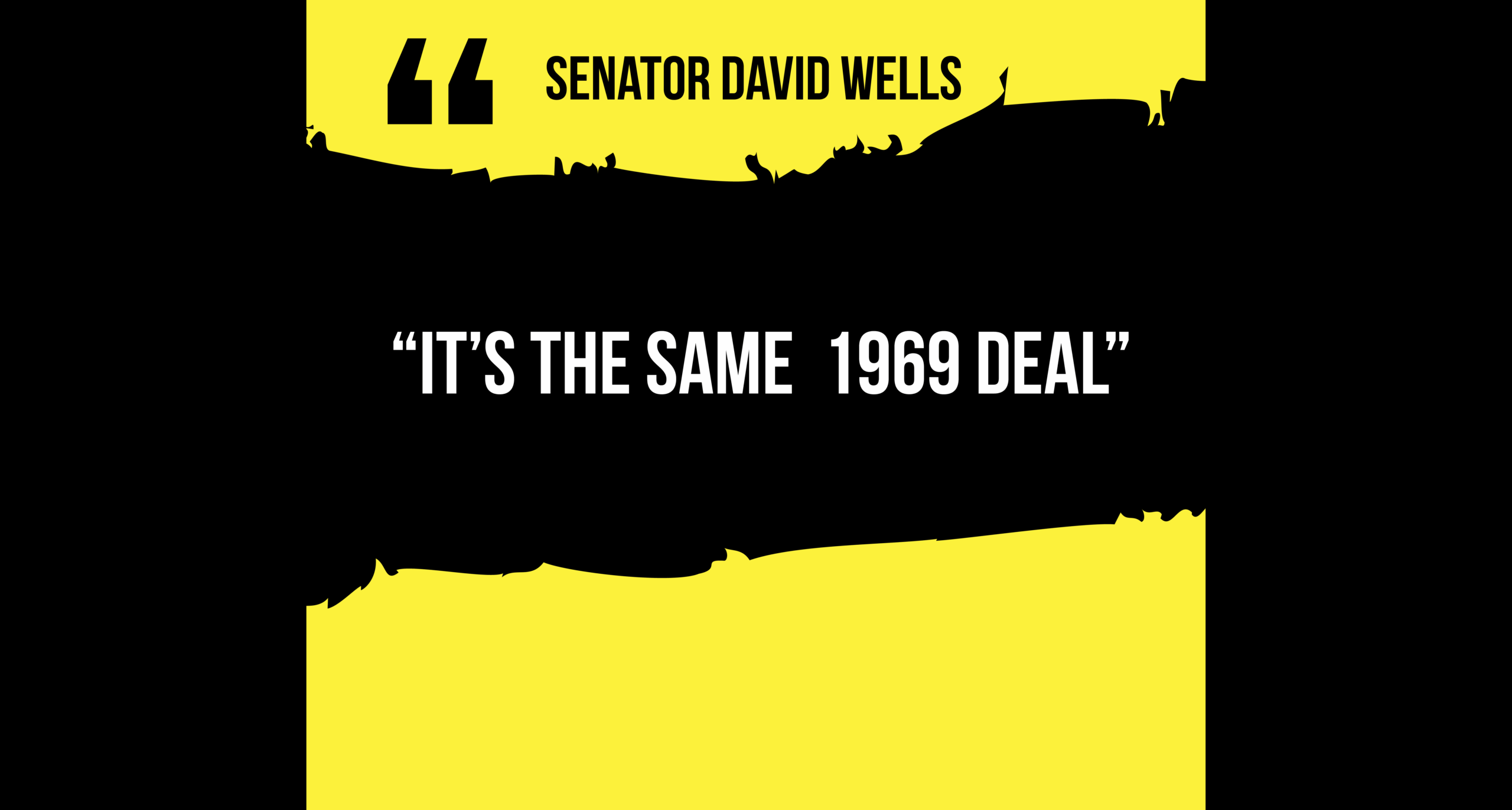

OPINION ‘The same deal as in 1969 at the end of the day’: NL must question Gull Island MOU

The Telegram – September 30, 2025

“The same deal as in 1969 at the end of the day” should prompt independent review of Churchill Falls deal, says Senator David Wells

Newfoundland and Labrador Senator David Wells Contributed

As Newfoundland and Labrador prepares for a provincial election, voters face an important decision that will guide the future of the Gull Island hydro project on the Lower Churchill River.

Right now, there is no issue that is more important to our province’s future. A memorandum of understanding (MOU) has been signed with Quebec, but many citizens — likely most — are unsure whether what’s on the table will deliver maximum benefit to our province over the long term.

We’ve been told by the government that we’ll get $225 billion over the life of the agreement. No doubt a big number.

We’ve been told we’ll get 5.9 cents per kilowatt (kWh) hour instead of the 0.2 cents we get under the ill-advised 1969 agreement.

A non-binding MOU between Newfoundland and Labrador and Quebec, for hydroelectric generation in Labrador, was announced Dec. 12, 2024. Photo by THE TELEGRAM

We weren’t told in the Liberal government’s press release that the current average market price in Quebec averages 7.8 cents, that Newfoundland and Labrador pays twice that at 14.8 cents, or that the average current price in the United States, where Hydro-Quebec sells a great deal of our hydro power, goes for 15.22 cents per kilowatt hour. That could explain why Hydro-Quebec’s lead negotiator said in an incautious moment that this is “the same deal as in 1969 at the end of the day”.

The Churchill Falls contract of 1969 remains a cautionary tale of how one-sided energy agreements can lock Newfoundland and Labrador into decades of disadvantage. We cannot afford to repeat that mistake, and we cannot afford to make a decision on this MOU based on the faith attached to politics and in the absence of evidence that this is the best possible deal that could be struck. I’ll remind you we cheered in 1969, too.

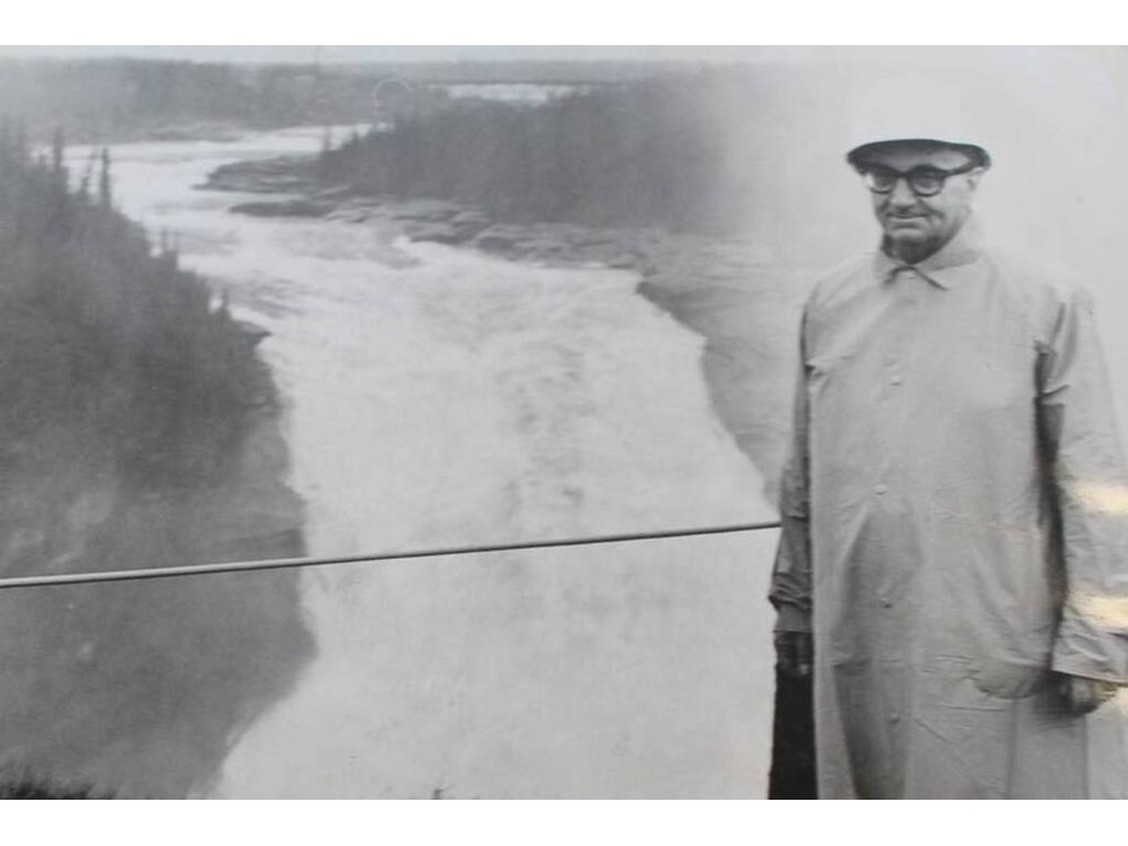

Former Newfoundland premier Joey Smallwood stands near the Churchill River in Labrador before the 1969 Churchill Falls power agreement was signed with Quebec. SaltWire Network file photo

The MOU with Hydro-Quebec is not a binding contract, but it does more than just set the framework for negotiations that will define our economic future for generations. It’s a stake in the ground, yet key questions remain unanswered. What safeguards exist to protect our interests? Does the agreement ensure fair long-term value for our province in a world hungry for clean energy? Is our province the first to benefit from rising energy prices for our own resource, or will we be the last again? Why must we consider Hydro-Quebec as our only option for a partner or customer? Have all reasonable scenarios and alternatives been considered?

These questions are not partisan; they are patriotic. This decision impacts our children and their children, too. That is why we need a non-partisan, fully independent assessment of the current MOU or any other framework, and its potential benefits, before any binding commitments are made.

Churchill Falls, Labrador. Photo by Hollis Yetman Jr./Contributed

The comment from the Hydro-Quebec lead negotiator that this is “the same deal as in 1969 at the end of the day” should, at a minimum, make us nervous about repeating a colossal mistake.

A truly impartial review by energy experts, economists, legal specialists, and hard-nosed negotiators would give citizens the facts they need to judge whether this path forward is fair, sustainable and right.

Without solid evidence and independent analysis, the public risks being asked to support a project of enormous consequence without full information or understanding, and without consideration of other options in a rapidly changing energy market.

Let’s also not forget that Hydro-Quebec owns now and forever 34.2 per cent of the Upper Churchill Falls hydro-electric project — even after 2041, when the current electricity pricing contract ends.

The Gull Island MOU grants Hydro-Quebec an astounding 40 per cent ownership. Have we learned nothing? For those unaware, Hydro-Quebec is 100 per cent owned by the Government of Quebec. To his full credit, former Premier Danny Williams didn’t give up one iota of Muskrat Falls ownership to anyone. That’s ours. Forever.

The Muskrat Falls power station. – Hollis Yetman Jr./Contributed Hollis Yetman Jr.

Hydroelectric power is one of Newfoundland and Labrador’s greatest assets. Goldman Sachs Research reported that the need for powering data centres will increase by as much as 165 per cent by the end of the decade, compared to 2023 levels. I was informed last week by a global artificial intelligence leader that AI companies like Google, Nvidia, OpenAI, Meta and Microsoft, if given additional electricity, would fill the supply. AI facilities also need massive capacity to cool their data centres. The Churchill River can do that, too. These companies have the money and the need to invest in such critical infrastructure for their own growth.

Managed wisely, our electricity can fuel growth, create jobs, and supply clean energy for our own value-added projects and well beyond our borders. Managed poorly, it would do all of that for Quebec. We cannot allow ourselves to be put in a fool-me-twice position.

We will surely move ahead with a Gull Island hydro-electric project, but before we do, let’s take a deep breath, assess this properly, and ensure that any agreement delivers the prosperity Newfoundlanders and Labradorians deserve.

History reminds us to tread carefully.

David Wells is a senator and has represented Newfoundland and Labrador in the Senate of Canada since 2013. He served as deputy CEO of the CNLOPB, director of policy and chief of staff to federal ministers, sits on the Senate Energy and Environment Committee and wrote the terms of reference for and is the founding chairperson of the Senate Audit and Oversight Committee. He lives in Newfoundland and Labrador.